Eurozone Q3 GDP Release ... Looking Forward

As has happened before here at Alpha.Sources I am going to break one of my promises; this one made this Friday. The concrete promise was that I would prepare a longer forward looking note on the Eurozone economy. I have not exactly collected enough firepower yet to do that although of course two main issues have been taken up a lot of words here at this space recently epitomized by the rather violent move in the EUR/USD as well as the outlook of a general slowdown in the Eurozone. In this entry we are of course, with the Q3 GDP figures, discussing the latter topic. Before I get into the actual outlook on Eurozone Q3 GDP which are out as preliminary figures on Wednesday (Germany's figures are out on Tuesday; see economic calendar here) and potential market implications I want to note a couple of general sources and references on the Eurozone economy. First off, I want to recommend my colleague and friend Edward Hugh's Eurozone Economy Watch which posts regularly updates and brief analyses on the evolution of the Eurozone economy and its economies. This blog also sometimes features my own analyses on the Eurozone economy. Secondly, I also want to note RGE's new kid on the blog in the form of the Europe Economonitor. At this point I won't do extensive plugging which will be the subject of the next installment in my ongoing series of 'recent additions to my blogroll.' At this point it suffices to say that the blog launched by RGE fields a remarkable array of specialists and intelligent commentators on Europe's economy. To be sure, this is already a benchmark for Eurozone commentary and economic analysis so be sure to bookmark it for later reference. Thirdly and lastly, I want to mention a rather programmatic paper from the ECB's research department. On the face of it the paper's subject look rather dull but clearly as a Eurozone watcher it is close to a must read. Quite simply, the paper fields an overview an analysis of the data methodology as well as general accuracy of the data published on the Eurozone economy. It's overall conclusion is this ...

Overall, the evidence presented in this paper suggests that euro area data releases have generally shown a very small or no bias and have been more stable than those for individual euro area countries. Furthermore, recent euro area data show levels of revisions similar to those of the past, or levels of revisions that stabilised after the implementation of harmonised statistical concepts had largely been completed.

But really, the paper is a good general read.

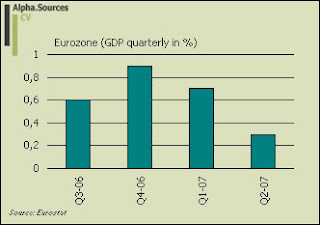

Having dealt with these introductory statements let us have a look at those Q3 GDP numbers shall we? In order to set the scene it might be an idea to revisit my entry on the Q2 GDP figures as they were released back in August and consequently some visuals on where we actually stand

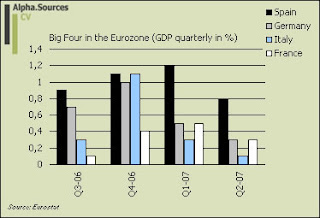

As we can see the Eurozone GDP took a hefty knock in Q2 slumbering to a 0.3% q-o-q growth rate where especially Italy's contribution of 0.1% should be watched closely since the number Italy is able to churn out this time around may tell us a whole lot about the prospects of a near recession in Italy as we move forward. In general as I also wrote back in August the slowdown to 0.3% on aggregate from Q1's more speedy 0.7% seemed a bit stark which is also why I hinted that Q3 figures should improve if only slightly. To be exact this is what I said;

As we can see the Eurozone has steadily slowed from a stellar performance in Q4 2006 to a much more meager performance in Q2 2007 as with a quarterly growth rate at only 0.3% on the back of 0.6/0.7% (depending on statistical measurements) in Q1 2007. In this light and even though I had indeed expected an aggregate slowdown 0.3% seems a bit stark and on that note I do expect the quarterly figures for Q3 2007 to improve but only slightly. Another possibility would be for the current GDP estimate to be adjusted upwards at a later stage.

Since there has been no revision we should expect aggregate Eurozone growth to come out a bit above 0.3%. The general consensus seems to be for Germany moving from 0.3% to 0.5% thus driving the Eurozone aggregate to that same number (0.5%). From BHF-Bank Economics Department (via FXstreet.com);

German GDP growth probably accelerated to about 0.5% quarter-on-quarter in Q3 2007. Output in the producing sector increased as well as retail sales. On 14 November, Destatis (the German Federal Statistical Office) is publishing a “flash release” on German GDP; a detailed breakdown of the components will follow on 22 November. So far, private consumption and net exports are likely to have had a favourable impact on overall GDP growth, with strong exports and imports. Investment in machinery and equipment probably contributed positively too. Changes in inventories and investment in buildings could have had a positive effect as well. French and Italian GDP are likely to have gained momentum in Q3 too. As a result, EMU GDP is expected to have increased by about 0.5% quarter-on-quarter in Q3. The EU Commission’s GDP growth forecasts are not likely to be revised significantly.

I am not at odds with this general forecast although I do think that the probability of a 0.4% growth rate is significantly higher than the upside which would be 0.6% but we will see soon enough. However, there are many important qualifiers to be attached. As for the general outlook a quarterly growth rate of 0.5% as a Eurozone aggregate would translate into an annualised growth rate of 2% flat; yet this assumes that Q4 also sees 0.5% growth q-o-q which I think is considerably more unlikely. In short; the Eurozone is almost certainly looking at below 2% in 2007 which really does bring back the whole reliability of the goldilocks discussion and whether in fact not the porridge is turning rather cold at this point. Moreover, we need to remember the fact that I have been at pains to hammer down again and again in the sense that the Eurozone is not one single economy. Especially, I want to emphasise the risk that Italy might already flirting with recession fulfilling the ill-earned role of the Eurozone's main whipping boy when times turn. Yet, and to add further to the potential downside for Italy other downsides are lurking. The external environment is riddled with uncertainty and this is having a very clear transmission effect into the financial markets where the new buzz word of the day 'credit crisis' still seems to be carrying a hefty echo in the halls of many a financial institution. As an important derivative effect of this we are also witnessing a widespread construction and housing correction in Europe where especially countries such as Ireland and Spain seem destined to come down from what admittedly also have been very high (growth) horses recently. Finally however, it seems as if the locomotive of the Eurozone Germany is also entering much more choppy waters something which, if confirmed, could clearly move the whole edifice closer to a standstill. Sebastian Dullien has a relevant analysis on the before mentioned Europe Economonitor in which he notes the following;

Moreover, the growth rate of roughly 2 percent in both the forecast from the council of economic advisors as well as the EU commission is only reached by assuming finally a robust pick-up in consumption demand. While there are some signs that German consumption indeed is improving (car sales seem to have picked up lately and retail sales have recovered from the VAT shock in January), so far, it is far from being a growth engine. Real consumption is forecast by the Sachverständigenrat to slightly shrink in 2007 compared to 2006, mainly as a result of the VAT hike earlier this year. For 2008, now the experts have penciled in an increase by 2.0 percent. Given the new record for energy prices, it is a risky bet to base the hope for a decent growth in 2008 almost entirely on a recovery of the German consumption demand, a component that has not grown by 2 percent or more since 2000 and that has continued to disappoint over the past years and has on average not grown between 2002 and 2006.

In contrast, both drivers of the German recovery in 2006 and 2007 are set to be almost disfunctional in 2008: Given the recent rise of the euro to a record high and the slowdown in the US and Japan, export growth is set to slow.

Of course and not in any ways to blow my own horn, whistle or whatever this is the kind of effect (alongside others) me and my colleagues have been ostensibly warning about ever since that illusive Q4 GDP reading seemed to throw the collective mass of economic analysts and commentators into a world of goldilocks where VAT hikes, interest rate increases, and a slowing US had absolutely no effect whatsoever on the Eurozone economic momentum. What remains to be seen now is the extent of the coming slowdown. At this point I would like to stress it is still too early to really call it. As for concrete forecasts Eric Chaney from Morgan Stanley recently put Q4 07 and Q1 08 to 0.4% q-o-q but he is also at pains to point out that this constitutes a somewhat optimistic call. If however, the numbers fielded above turn out to be correct it will translate into a 1.9% aggregate growth rate for 2007. I am not that optimistic and I am closer to 1.7% but this is really also number salad since if we go back to the beginning of 2007 we clearly see that the forecasts fielded at that time was pretty much off the mark and also somewhat more than could traditionally have been expected due to the obvious fact that none of us can see into future.

Market implications?

To put it in very few words we now have on our hands, is a lot of downside and very little upside. In general I am looking for three things. Firstly, Italy (and also Greece and Portugal) needs to be watched closely since my feeling is that these countries might very well take a hard knock as the first economies in line. This will then bring all kinds of issues of debt/fiscal deficits and structural reforms to the forefront not to mention those much unwanted debt downgradings. Secondly, I am also watching the EUR/USD, not so much because I want to make quick money but rather because, as I have argued before, it is beginning to look increasingly more as if global liquidity is moving rather quickly in accordance with the notion of de-coupling and re-balancing. I don't want to roll out my argument here but people need to think about new causal relationships and interlinks; e.g. something along the lines of how comments made by Chinese monetary officials might end up influencing whether Italy (or Portugal or Greece for that matter) stays in the Eurozone or not. Thirdly, I am also watching the Eastern European countries VERY closely since a byproduct of this EUR/USD show is that the pegs are being pushed to the limit; add to this all the other inbuilt economic issues as they have been described at length here we are looking at a potential very inflammable situation. Inflation numbers on the Baltics in the coming week will confirm I think beyond any doubt that this is moving rapidly towards an endpoint which does not look.

As for the formal market implications the current rather volatile environment makes for many a potential analysts to come off as very smart but also, as it were, to end up looking like blatant fools. For the record; I don't see the ECB taking it to 4.25% in 2007 and I don't think the EUR/USD will rise beyond and close to 1.50. However, those predictions might soon be proven wrong (the latter as soon as later today), so please don't bet money, if at all, on this.