Q4-07 Eurozone GDP - A Little Bit for Everybody

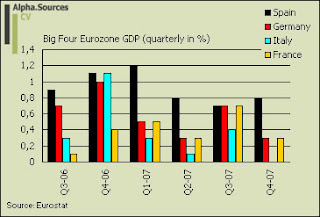

As you might have already heard we recently got the provisional data on the Eurozone Q4 07 GDP data. One of the interesting things in looking forward to this specific release was the extent to which the result would have any bearings on the ECB's decision to potentially lower rates as soon as H01 2008 and perhaps even, although this was always distinctly unrealistic, in the coming March session as I myself has been tentatively musing in my recent Eurozone watch notes. Well, let us have a look at the data and subsequent comments from various market observers to see whether we could not in fact find out. We will begin with the graphical version ...

Given the fact that my readers are not all ardent Eurozone watchers and thus may not have been reading my most recent scripples on the subject I think it would be nice to point out specifically where I am vindicated in terms of my expectations for this release. Firstly, on the overall number I am not at all surprised to see that the Eurozone seems to be slowing noticeably at the end of 2007 and into 2008. If anything, I am a bit surprised on the upside that the zone managed to clock in 0.4%. The main source of this surprise undoubtedly comes from the continuing rather brisk performance of Spain. It is true that Spain has slowed down a bit from the beginning of 2007 to a sub 1% level on a rolling quarterly basis but a growth rate of 0.8% in Q4 is still very impressive. Note in passing that Spain actually accelerated a tad from Q3. Of course, this may soon change a lot since the incoming news we have had recently from Spain suggests that more meager periods are in store pointing to the fact that Spain now seems to be verging on the end of a 5 year growth spurt of significant magnitude. The picture derived from the y-o-y figures also seem to confirm this point. Yet, there is no doubt in my mind that the reason that the Eurozone is not flirting with a number more akin to the 0.2%ish range in Q4 is largely a result of Spain's strong performance. As such and if we move to the rest of the big four countries in the Eurozone the figures are much closer to what I had expected. The most notable points in this connection which can be directly derived from the figures above center on France and Germany which both slowed significantly in Q4 going to 0.3% from Q3's 0.7% on a q-o-q basis. What will be interesting now of course is the extent to which this picture will brighten, worsen or stay the same as we move forward? I would be surprised to see much of a rebound in either Germany or France noting the main reservation that I am expecting domestic demand to hold up considerably more in France than in Germany. In this way, I am not quite in agreement with Morgan Stanley's Eric Chaney (15th February edition) when he says ...

Given the fact that my readers are not all ardent Eurozone watchers and thus may not have been reading my most recent scripples on the subject I think it would be nice to point out specifically where I am vindicated in terms of my expectations for this release. Firstly, on the overall number I am not at all surprised to see that the Eurozone seems to be slowing noticeably at the end of 2007 and into 2008. If anything, I am a bit surprised on the upside that the zone managed to clock in 0.4%. The main source of this surprise undoubtedly comes from the continuing rather brisk performance of Spain. It is true that Spain has slowed down a bit from the beginning of 2007 to a sub 1% level on a rolling quarterly basis but a growth rate of 0.8% in Q4 is still very impressive. Note in passing that Spain actually accelerated a tad from Q3. Of course, this may soon change a lot since the incoming news we have had recently from Spain suggests that more meager periods are in store pointing to the fact that Spain now seems to be verging on the end of a 5 year growth spurt of significant magnitude. The picture derived from the y-o-y figures also seem to confirm this point. Yet, there is no doubt in my mind that the reason that the Eurozone is not flirting with a number more akin to the 0.2%ish range in Q4 is largely a result of Spain's strong performance. As such and if we move to the rest of the big four countries in the Eurozone the figures are much closer to what I had expected. The most notable points in this connection which can be directly derived from the figures above center on France and Germany which both slowed significantly in Q4 going to 0.3% from Q3's 0.7% on a q-o-q basis. What will be interesting now of course is the extent to which this picture will brighten, worsen or stay the same as we move forward? I would be surprised to see much of a rebound in either Germany or France noting the main reservation that I am expecting domestic demand to hold up considerably more in France than in Germany. In this way, I am not quite in agreement with Morgan Stanley's Eric Chaney (15th February edition) when he says ...

Germany and France both reported 0.3%Q GDP growth, in line with our forecasts, with nevertheless a significant divergence in domestic demand trends, surprisingly weak in Germany and surprisingly strong in France. We would expect some convergence in the near future.

It will indeed be interesting to see whether 0.3% represents a kind of bottom level for the two big Eurozone countries or whether they have further to go down. The only piece of information missing in action at this point comes from the Italian Q4 GDP which was not reported as part of Eurostat's provisional estimate. This is rather important in the context of the pet homegrown forecast here at Alpha.Sources where an important tenet has been the prediction that Italy as the first of the big Eurozone country would fall into a recession and that this was likely to have happened already in Q4 2007. Since we have no data it is of course impossible to say for sure but following the Economist's estimate which they take directly from Barclay's Capital Italy did indeed see a contraction in Q4. The Economist's graph reports annual (quarterly) numbers so the -1.8%/-1.9% contraction cannot be directly translated to my graph above although a fair estimate would be for a 0.2-0.3% contraction on a rolling quarterly basis.

If the points above constitute the stylised facts as well as the points where I was vindicated and proven wrong what does this mean for the future ECB decisions not to mention the overall outlook for the Eurozone? Well, here at Alpha.Sources the principle of standing on the shoulder of giants is a cornerstone of the reporting process so let us see what others have to say.

Returning to Chaney, he as per usual for MS's Eurozone watching team (Bartsch is apparently out of office this time around) offers some interesting insights into the immediate future. As for Italy Chaney quotes Morgan Stanley's Italy watcher Vladimir Pillonca for noting that Italy probably saw a stagnation in Q4 rather than an actual contraction. More importantly however he fields a forecast for Q1 2008 in the region of 0.4 to 0.6% q-o-q depending on the gauge you are looking at. To me, this sounds a bit optimistic and since I expect a noticeable slowdown in Spain as well as a status quo in Germany in France I am looking for something around 0.3 to 0.4% with a bias to the downside. This is of course all number salad in the big picture but it is rather important in this current climate where the business cycle is turning. On a general level I do concur however with Chaney when he says that the credit crisis and specifically its impact on the Eurozone is likely to stand out as function of its length more so than its depth. Notable downsides can be identified to this point however and here I think that events in Eastern Europe and most emphatically in Hungary may well turn out to make matters a bit more complicated than is presently expected. Another notable comment in the context of the recent GDP release in the Eurozone came from the Economist (linked above) where I specifically noted how the article was the first in quite a while from the fine scribes at the Economist to argue against the thesis of de-coupling. I also note with much pleasure and agreement the last paragraph in the article where the travails of Eastern Europe are mentioned as potential sources of spill-over effects to the Euro area. I am not trying to assume some kind of 'I told you so' mantle here towards the Economist but simply noting that we all change our minds when new evidence is presented for us; I personally take great honour in seeing scientific progress this way. Meanwhile, the debate on de-coupling and re-balancing thunders along. Stefan Karlsson who is fast becoming my favorite blog for Austrian economic commentary seems to take the Q4 release to heart as a sign that de-coupling is fairly well on track. Now, Stefan and me see the world quite differently which also leads us to disagree on quite a few topics and decoupling would be one of them. However, this is perhaps also why I read him so often these days. Oh, and did I mention that the de-coupling debate is all the rage? I can hardly punch the keys fast enough to keep up and thus David F. Millelker posts over at RGE´s Euromonitor about not falling victim to what he calls the "de-coupling complacency". As ever, those well proven empirical facts should not be forgotten

As so often, professional forecasters are currently coming up with lots of reasons for a potential decoupling of the European economy only to be disappointed by the fact that all the data tend to show is a secular tendency for a time lag of six to twelve months between the US and the European business cycle.

The discussion of Europe's and the Eurozone's time lagged inter-relationship (basically, we use fancy distributed lag models in econometrics to show this) with the US is interesting in and of itself. But much more interesting is the extent to which the Eurozone could ever have been expected to de-couple from herself as well as from those high hopes that she could take up the baton in the global economy, as the US slowed, to head a grand scheme of global rebalancing. On both accounts we need to remember that ever since the de-coupling debate really caught wind the ECB has raised rates, key economies in the zone have embarked on fiscal tightening to reign in excessively large budget deficits, the US has in fact been slowing, and the EUR/USD has been taken to new highs on the expectation that none of the former issues had anything to do with the Eurozone's ability to muster the load. Even now, the de-coupling debate continues as two new risks enter the equation in the form of persistent and consumer purchasing power eroding headline inflation (the EUR/USD being a mitigating factor here) as well as of course that illusive credit crunch which seems to be affecting anything from regional Spanish cajas to Hungarian households. In short; it's the fundamentals stupid! And I have not even mentioned demographics yet but this is for another moment I think.

Ultimately, I am circling the hot porridge here am I not? What is it with the outlook on the ECB decision then? Although the slowdown in Q4 was noticeable I don't think it will be enough to make true my forecast that the ECB could be moving in with a lowering as soon as March specifically on the back of the Q4 figures. This means, and despite the clear change in discourse at the ECB recently, that we will see rates being held steady throughout Q1 2008. Will we see action in Q2 then? As ever, inflation data will be important since the ECB has, at this point, indicated that it is pretty elastic towards the steady incoming stream of bad news from the real economy. However, given Trichet's reference to downside risks to growth and given the way I see things moving in H01 2008 I don't see how the ECB can avoid to lower rates once before June this year. Not everybody agrees though. Eurointelligence recently moved in with a call that the ECB would hold rates for Q2 2008 citing stronger than expected inflation (second round effects from wage negotiations) and stronger than expected growth dynamics.

So we remain outside the interest rate consensus. We do not see a rate in Q2, and as of now we are reluctant to look beyond the current quarter.

For another detailed assessment of where the ECB is heading Aurelio Maccario noted a couple of weeks back over at RGE's Euromonitor how the ECB would have lowered rates to 3% by the time we reach mid 2009. Re-visiting the timing issue it seems that he also sees a steady policy until we reach H02 2008. As such, it should appear clear that the consensus may be a bit shaky as to the actual timing of the ECB cuts much more than we all agree that we will see cuts in 2007. Yet, the timing decision does have quite significant implications for some markets not least the FX market where the EUR/USD seems to have settled, after some roller-coaster movements during the FED's emergency tinkering, at around 1.46-1.47. I noted recently how I don't see the pair flirting with 1.50 seeing as if it was bound to go there it would have done so already. I see stickiness around these values as we move forward the next week noting in passing of course that the spread of 1000 pips itself leaves plenty of room for speculators to have their way. Expect also the Euro to strengthen significantly against key Eastern European currencies, not least the Forint and the Leu.

In Conclusion

The Eurozone Q4-07 GDP release revealed a noticeable slowdown from Q3 clocking in at 0.4% q-o-q for the aggregate zone. This surprised me on the upside. Spain in particular constitutes a surprise as the economy continued to expand at a q-o-q rate closer to 1% than 0.5% and below. France and Germany slowed visibly to 0.3% which was largely in line with my expectations. Italy also conformed to my expectations having almost certainly slipped into negative growth rates on a rolling quarterly basis. For Q1 I see status quo in France and Germany (0,3-0,4), a notable slowdown in Spain (0.4-0.5) and a minor correction (possibly 0.1%) in Italy depending on the actual number released for Q4. These calls would translate into a Q1 08 Eurozone reading of 0.3% in my book on a q-o-q basis. My bias to these figures are on the downside.

On the back of these Q4 figures and unless the heaven falls down on the Eurozone in the form of e.g. an imminent currency/financial crisis in Eastern Europe rates will be held steady as the ECB convene in March. I am moving in accordance with the consensus in forecasting at least one cut in the refi rate in 2008. The timing of this/these cut(s) is subject to more uncertainty. I see one cut in H01 of 2008 but concur that the consensus does not seem to agree with me (or is it the consensus that does not agree with Eurointelligence?). The EUR/USD is to remain sticky around the 1.46-1.47 mark holding its ground until more data reveal itself on the economic fundamentals and inflation dynamics of the Eurozone. The industry and business confidence readings expected at the end of February will be important here so watch out for those. Conditions in key Eastern European countries seem to be deteriorating to such an extent that the recent appreciation of the Euro vis-à-vis especially the Forint and the Leu seems set to continue.