Equities Finally Get the Memo

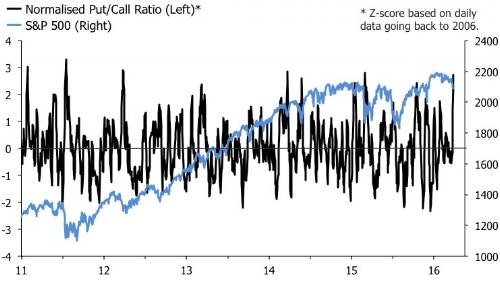

After a week's break, and a detour, I am back in the saddle for a busy run-in to Christmas. The main market mover of note, while trawling the museums and bars of Paris, was that global equities finally showed a bit of weakness. The MSCI World slid 1.8% last week, down 4.8% from its peak in August, which means that the index is flat as a pancake year-to-date. A belated reaction to the recent mini tantrum in bond markets, or a knee-jerk reaction to tighter polls across the pond, are probably the lazy strategist's reason for the sell off. But it has been coming regardless. As per usual, the bulls and the bears both have indicators to suit their narratives. In the short run, the bulls have reason to be confident. The chart below shows that the normalised put/call ratio on the S&P 500 has surged, which implies that investors have been hedging aggressively going into the political festivities this week. Based on the idea that the market usually takes the route that delivers the most pain to unwary punters, it would suggest that a snap back is due. It would also imply that the exertions of U.S. democracy will amount to nothing more than a damp squib. If Hillary wins, the security of the status quo will be outweighed by the gloomy prospect of a more emboldened Fed. If the Donald wins, the fear of uncertainty will be matched by the likelihood of the FOMC finding yet another reason not to move, and the fact that Trump is more likely to boost growth than to quell it, at least in the short run.

Too worried going into the elections?

The put/call ratio is just one indicator, though, and not much to hang your hat on, at least not with any solid conviction. The main view here remains that any reprieve will be short-lived. Breadth, for example, continues to deteriorate in large-cap U.S. equities signalling that further weakness is in store. In addition, the trusted valuation score continues to signal further weakness in returns, which is poised to extend well into Q1.

The market is on thin legs

The sell-off is not done yet

Could there be a lesson for seasonality chasers here? With a broad stroke, the combination of a flat market year-to-date in November and modest economic growth would seem the perfect setup for a Santa rally. But I suspect the usually so trusty "seasonal indicator" got a whack last year. In case you don't remember, the MSCI world peaked in late October, flat-lined in November, before it took a deep dive, which didn't let off until the middle of February. No Santa rally here; just a low-volume meltdown, which became a rout in Q1. To put all your chips on an exact repeat this time around obviously would be really lazy. The main message, however, is that dip-buyers should be patient. There is a good chance that your shopping list will get cheaper still.

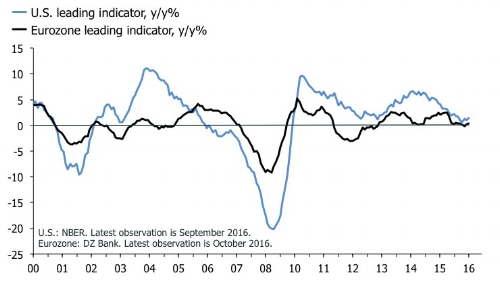

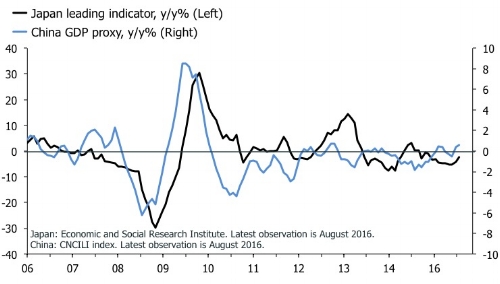

Improving global leading indicators?

Elsewhere, the latest batch of headline macroeconomic leading indicators was upbeat across the board at the end of Q4, and in the beginning of Q4. In the U.S., the NBER LEI rose 1.5% year-over-year, in September, up from 1.1% in August, and in the Eurozone the DZ bank LEI edged higher by 0.4% in October, up from a 0.2% rise in September. These growth rates are decidedly timid compared with previous cyclical "expansions", but the direction has been upbeat in recent months. Indeed, the upbeat story extends to the major Asian economies where headline leading indices also have picked up in China and Japan. Looking under the hood of these headline LEIs—which is what my PM colleagues and me do on a daily basis—always complicates the story somewhat. The overall picture that we are late in the cycle hasn't changed. But I'll take the good news when it is presented to me.

The Brexit parody continues ...

Finally, the ruling that parliament must be consulted before May's government can trigger Article 50 has predictably kicked off a huge fuss among the hardcore Brexiteers. The decision, obviously, will be appealed to the Supreme Court, which is scheduled to rule in the beginning of December. The meat of the situation, as I see it, is the following: If parliament shoots down the government's mandate to trigger Article 50, new general elections must be held. As such, I doubt it will happen because this is exactly what May will be telling her pro-EU backbenchers, undoubtedly in a threatening tone. With respect to the rest of the parliament's incentive to throw a wrench in May's wheels, I doubt they will follow through, but I admit limited knowledge about the situation. The alternative is that May et al. actually want new elections, but I will let the peanut gallery speculate on this.

In terms of the more spectacular editorials from the lower echelons of the press about the British judicial betrayal of the free will of the people, it is difficult to say much interesting. They should read up on their Montesquieu, and the separation of powers, to begin with. Then, once the red mist had cleared, they would realise that the situation hasn't changed at all. It sure does look ugly, though. It is difficult to discuss this particular topic, especially as an EU worker living in the U.K. Friendships and personal relations already have been strained as a result. If the current deterioration in the debate continues, however, the U.K.'s EU population eventually will get the memo, and leave. Maybe it will be for the better.