Three Ideas to Avoid the Political Soap Opera

Investors were forced to endure further distractions at the hands of Brexit and the new U.S. political leadership last week. Theresa May's speech, which lifted the lid slightly on the government's plans for its exit from the EU, and Mr. Trump's inauguration address were undoubtedly the most important events for markets. This tells you all you need to know about how it is to be an investor at the moment.

Fear not, though; I am here to help. I won't talk about Mr. Trump or Brexit [1] in this post, but instead ask the question of how equity investors can escape their vortex. This is not easy, and some would argue impossible. I think it is an important exercise, however, in a world where political emotions easily take over from cold and rational decision making. Specifically, I want to focus on emerging markets. EM equities, as an asset class, are not completely independent of the political machinations in the West. Just look at Mexico. Perhaps the downside from Trump's and Navarro's evil eyes have already been discounted, but picking up value in Mexico is a pretty linear bet on U.S. economic policies. That said, if we are going to find investments on the long side [2]—which admittedly is getting increasingly difficult—I think we should start in EMs.

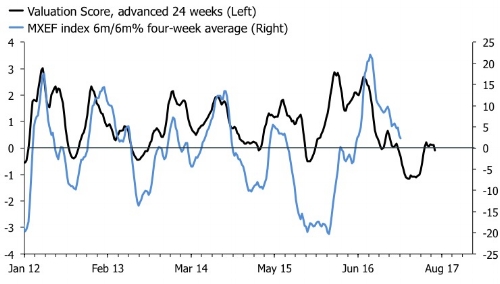

The big picture on EM equities changed dramatically last year, following a long period of misery. Flows came back and the MSCI EM ended the year up 7.2%, after a 15% and 5% decline respectively in 2015 and 2014. The MSCI EM rallied almost 30% from February to September, and that's perhaps why the index has moved sideways in the past six months. My first two charts provide an overview. Trailing returns on the MSCI EM have fallen steadily since Q3, and my valuation score suggest that the downtrend will continue in Q1. In contrast, three-month flows on the MSCI EM suggest that investors already have sold out, pointing to a low base for a rebound.

The annoying conclusion is that the headline EM index appears to be carving out a buying opportunity, but that we aren't there just yet. This story isn't dramatically different from what I am seeing in other major global markets. As argued last week, I think risk assets generally are priced for weakness in the next few months, in particular because the euphoria around the growth prospects in the U.S. looks overdone. The key difference in emerging markets, however, is that the macroeconomic cycles appear asynchronous relative to the major OECD economies. In effect, many emerging markets are just now coming out of recessions, while others appear to be mid-cycle. This is in contrast to most OECD economies where the business cycle appears to be in its later stages.

India, not cheap but could still deliver

Assuming that China is going to butt heads with Trump over its currency, cheap manufacturing exports and everything in between, India is arguably the best mainstream EM story out there. It has a huge domestic market, very favorable demographics and sound institutions compared to the train wreck in many other EMs. In addition, I am in decent company on this one. Jeff Gundlach recently reiterated his fondness for assets in India, specifically referring to overvalued and politically uncertain markets in the U.S. and Europe. I conditionally agree.

I think Indian equities are an obvious overweight in an EM equity portfolio. But multiples already have rebounded strongly from their most "recent" cyclical trough all the way back in 2012. The first chart below shows that my valuation score suggests a buying opportunity is coming closer. The second chart, however, shows that you'll have to pay up. A trailing P/E ratio just shy of 20 actually is mildly expensive if we look at the SENSEX. In the past this index has hit cyclical lows of around 10 in order to create the best buying long-term buying opportunities.

Two news stories in India have hit the global financial wires. The first is the rather odd, and brutal, attempt to demonitise the economy in order to clamp down on illicit activity and a flourishing black economy. The Economist thinks the move was ill-advised despite luminaries such as Ken Rogoff proclaiming the Curse of Cash. Getting rid of big black economy makes sense for the Indian government, but it is difficult to argue that the move was carefully planned. India is still a rural economy in large parts of the country, and is severely underbanked compared to for example Denmark where it has also been suggested to scrap cash given that no one seems to be using it anyway. According to the Economist, the 500- and 1,000-rupee notes banned in India made up 86% of the cash in circulation! Looking ahead, the silver lining could be that more of Indian's poorer citizens are pushed into the ordinary banking industry. If that is true, it means a larger deposit base for the country's banks, which means more money for lending, and more revenues. At least, this is the theory. Nothing is certain, but a bull case for Indian banks is in the offering here perhaps. Incidentally, the big banks in India have ADRs listed in the U.S., which might be handy information given what comes next.

As such, the second interesting news story out of India was the "clarification" issued by the Indian ministry of finance over Christmas, which instructs fund managers to withhold and pay taxes when investors sell their stakes in offshore vehicles at a profit. Andy Mukherjee from Bloomberg is not amused. Moves likes this add to the pile of a long list of issues that India has had with foreign investors taking "direct" part in the India's growth story. This is the case for both portfolio investments, as is the case here, and FDI. This seems odd for an emerging market, but India has significantly reduced its current account deficit since it hit about 5% of GDP in 2012. If the current trend continues, it could even be zero this year. In other words; India doesn't really need to cater for foreign investors. Mr. Mukherjee summarizes the predicament as follows;

The tax authorities say they'll spare investors who own less than 5 percent of a fund. That might mitigate the industry's headache, but it wouldn't eliminate it. For example, the U.S. state of Tennessee owned 17 percent of the iShares India 50 ETF in September. If it sells some of its shares on the Nasdaq, India will want a piece of the gains. But how can the manager, BlackRock Fund Advisors, keep track of whether any 5 percent-plus holder has made a profit on a stock exchange? The paperwork alone would be a nightmare.

Pleas already have been sent to the Indian tax authorities to amend the rules, and I wonder whether we the laws of economics are about to play a trick or two on investors here. After all, if you know that the current rules mean you're taxed heavily if you sell, but that there is a chance they will be changed, you won't…you know…sell. If foreign capital finds itself "captured" in this sense, it could lead to some "interesting" price behaviour.

Turkey, see no evil hear no evil?

I am tourist on the politics, but my first impression would be that Turkey is turning into a cesspool, and that foreign investors have no business financing whatever is left of a normal market economy in the country. But market data don't care about politics, and they currently suggest that investors should don the kevlar. The first chart below show trailing returns on the MSCI Turkey, in USD terms, versus my valuation score. The message is unequivocally bullish. The second chart shows that the 12-month trailing P/E is just below 10. This market haven't been able to command much higher than 12-to-14 in previous bull runs, but that still leaves room for improvement.

This is one of those trades, though, where the abyss could be a lot deeper than the market expects. Just consider the following reservation from Grant's Interest Rate Observer, who also recently advised their readers to dip their toe into Turkey.

"Our conviction is that things in Turkey will be better—its stocks higher, its yields lower—in three years' time. We have no conviction that this is the bottom."

Three years?! Don't tell me that you haven't been warned. The models presented above suggest that investors won't have to wait that long to earn good returns, but it goes to show what we're dealing with here. The good thing about Turkey, though, is that it is one of those trades that could well go on a run independent of the curveballs thrown by Mr. Trump and Brexit.

Chile, the forgotten OECD economy

As in all good tales, I have saved the best for last. I have long thought that Chile is a bit like a forgotten jewel in the global economy. It's generally considered a play on China given its large copper exports, but Chile has generally been smart in the way it has managed its windfall from copper via the build-up of a sovereign wealth fund. In addition, there is more to this Latam economy than just commodities. It is an OECD economy, which suggests that we shouldn't really consider it to be "emerging" at all. It has a big and growing services industry too, especially in finance. Now, the economy hasn't been doing well as of late, and neither has its main stock index. But in line with the overall recovery in Latam equities, the rebound last year was encouraging. In addition, it appears that the central bank is getting control of inflation, which usually means that it can allow the domestic economy to "breathe" again. Here is how my colleague Andres Abadia described the decision by the central bank to cut rates last week.

"Policymakers pointed out that global financial conditions have improved and EM economies have gathered momentum. The Bank underscored that inflation is surprising to the downside and that long-term inflation expectations remain in the target range, while short-term inflation expectation are below the target.

In addition, the Bank highlighted that activity is still poor, especially in the non-mining economy, and that the labor market is weakening. Looking ahead, policymakers maintained their easing bias, saying that “should recent economic backdrop trends continue it will be necessary to increase monetary stimulus”. As such, we expect the Bank to cut rates by a further 25bp in February."

No sound investor would invest in anything based on the assurances of a central bank. But the overall picture is, I think, that Chile has turned a corner. After all, the key to invest in most EMs is to trade the inflation cycle. When inflation is falling and the economy is in its earliest stages of a cyclical rebound is when equities usually offer the strongest returns. GDP growth in Chile has rebounded, albeit modestly, from the near-recession in 2014, and both consumer and business sentiment have shown tentative signs of stabilisation and even a timid increase. Equities in Chile have continued to struggle, and it was only last year that the MSCI Chile—ECH US index is the biggest ETF—finally recaptured some ground. My equity indicator suggest it could be due another move higher, following a six months of sideways price action, where Trailing 24-week returns have just recently dipped below zero.

If you're still convinced that buying beta in Chile is just a play on copper and China, then I have thrown in a single name into the mix too Cencosud is one of the largest operators of shopping centres and other retail stores in Chile and Latin America, its ADR listed in the U.S. makes it relatively investable, and it is currently cheap, at a first glance at least.

If we carefully assume that Mr. Trump is not about to dump a nuke on Santiago, it stands to reason that people in Chile will continue to do their groceries. Indeed, they might even be spending more this year as inflation falls and interest rates decline. That's not the worst situation to be in for a retailer. Of course, whenever someone in finance mentions retailing these days, the knee-jerk response seems to be when the next funeral will be. Online trading—personified by Amazon—is like a pandemic for traditional brick-and-mortar retailers, and the last victim has yet to be claimed. I will honestly admit that I don't know the extent to which this story applies here too. But if we're debating whether this company will remain a going concern, I think we are on the safe side. Also, sifting through the transcript of the Q3 earnings call suggest to me that considerable effort is being made to develop and lock in the online services part of the business.

So there you have it. Three concrete ideas to sink your teeth into that have little to do with the Trump presidency or Brexit. It won't get you as far away from current events as Voyager, but it might help you to escape the worst of the political soap opera.

--

[1] - I gave my initial opinion here, and I have seen nothing which has convinced me to change my mind.

[2] - Shorting the world because you think Trump/Brexit will be a disaster is relatively easy. You don't need my help to do that.