Into the summer lull

We have had the first proper summer days in the north east of England this weekend, and they've been delivered just in time for the Hoppings. For those uninitiated in the folklore of Newcastle living, it does not get much better than that. It is tempting to extrapolate this state of affairs to the coming months, and hope for a warm summer lull. But experience suggests that would be complacent. Rain is forecast for next week. We should enjoy it while it lasts.

In markets, last week offered up another pinch of curve flattening across the pond. The Fed raised rates, as expected, and also signalled one more hike this year. The hawkish bias surprised some punters which had been looking for the Fed to climb down in light of recent underwhelming inflation prints. As far as I can see, though, the Fed didn't really veer off course. Central banks are like super tankers; they move slowly and persistently. The FOMC reiterated that it is in a three-hikes-a-year mode and that it continues to expect the labour market to tighten. If this is a traditional cycle, the Fed will stay the course until something breaks somewhere.

This brings us to the issue of the flattening yield curve in the US. Everyone is now talking about this, despite the fact that the curve has been flattening since the beginning of the year. The attention probably is because even short-sighted investors are now able to squint an inversion on the horizon. I laid out my views on this a few weeks back pointing to four possible scenarios. In recent conversations with market participants, I have made it clear that whatever happens next, the course of U.S. bonds will decide the fortunes of most other asset classes.

For good measure, I repeat them below.

1) The parallel flattener - In this scenario, the Fed raises rates about five times in the next 18 months, and two-year yields go north of 2%. The curve flattens, but also performs a parallel shift higher. Crucially, in this scenario 5-year and 10-year yields increase—substantially—but less so than the 2-year yield, which will soar as the Fed pushes ahead. In this scenario, the curve does not invert in the next 18 months, but it will be very flat at the end of it.

2) The Trump steepener - In this scenario the Fed also raises rates five times toward the end of 2018, but the economy improves faster than the Fed can keep up with. Presumably, this could only happen if we observed a serious "ketchup effect" in terms of inflation and nominal growth and/or if the White House suddenly delivered on both infrastructure and a bullish—but not protectionist—tax reform. Needless to say that this scenario would be cold steel for bondholders across the curve, but especially for duration bulls.

3) The u-turn - In this scenario the Fed is spooked by the dramatic flattening of the yield curve in response to even a modest hiking cycle. As a result, the FOMC backtracks and shuts down the hiking cycle. Given the silliness being practiced at the BOJ and the ECB, I reckon they could just about get away with this by blaming their foreign colleagues, but let's face it; it wouldn't be a good look for Yellen and company. If this forecast is true, I have to assume that Spoos and Blues will fly high. EDs will soar, and stocks will continue to grind higher on the promise of extended low rates. 5-year and 10-year yields should push higher, and the curve should steepen.

4) The great inversion - In this scenario the Fed pushes ahead, but bond markets won't have it and the curve continues to flatten. It is important to understand here how quick the curve would invert if this is the case. Think about 5-year and 10-year yields, which are now at about 1.7% and 2.1% respectively. If the Fed moves further and the current trend persists, we're looking at an inversion as soon as Q1 next year. The main victim here has to be the stock market. From the perspective of the Fed, this scenario would signal a bold Fed, which is willing to suffer the slings and arrows of an inverted yield curve in order to achieve a good distance between itself and the zero bound.

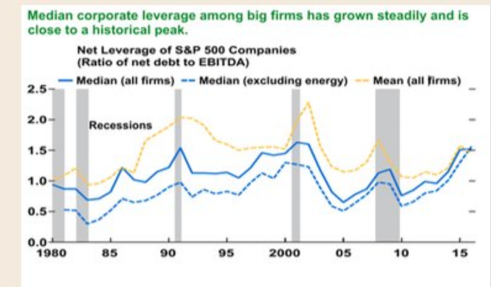

If the current trend continues—and this is a big if—the curve will invert soon; I reckon the 2s5s could invert as soon as Q1 2018, and the 2s10s should follow soon after. Does it matter if it does? In a normal cycle, a US curve inversion means that financial market participants who depend on short-term financing get stung. Levered banks with high loan-to-deposit ratios and some other financial intermediaries fall in this category. In addition, many corporates have outstanding credit facilities that are financed via U.S interbank rates plus a spread. It isn't fun to be maxed out on these when the Fed is moving. In general, anyone with variable rate USD liabilities suffer, eventually, when short-term yields move higher. Many global actors also are sensitive to a rise in short-term U.S. financing costs. In a textbook cycle, a yield curve inversion then becomes a classic late-cycle signal. It is often a harbinger of a U.S. recession and a global slowdown.

But does this "textbook" analysis carry weight now? Sean Corrigan, market muse for Cantillon Consulting, took me to task on Twitter last week. He pointed out that the US 2s10s is far from previous danger levels, and also that the curve partly is bull flattening—i.e. as a result of lower 10-year yields—due to excess global liquidity. In addition, he noted that 2-year yields appeared to move in line with risk assets.

I have great sympathy for the first argument. The main reason that we're discussing the prospect of a U.S. yield curve inversion with the Fed barely out of the first gear is that the ECB and the BOJ are stuck in a deep hole. Recent communication from Frankfurt and Tokyo suggest that it will take a long time before policy will be normalised. This means that it is difficult for the Fed to get traction with long rates. In the extreme version of this story, they just have to wait for the ECB and the BOJ to reach a point where they can start to withdraw accommodation. Cue the inevitable Beckett jokes. In terms of the second argument that 2-year yields are moving in line with risk assets, I don't really think this matters. Risk assets will move in tandem with higher yields until they don't ... it's the switch, which we need to be interested in.

Bloomberg's Cameron Crise piles on the pressure in his recent missive, reiterating Sean's point that the US curve isn't extraordinarily flat at this point. He notes that:

"The curve usually has to invert to signal recession (the ultimate outcome of a hawkish policy error), and we’re a long way from that. In fact, my work suggests that the curve is exactly where it should be based on current monetary settings, using a 1996-2014 sample period. Moreover, we have the historical precedent of the second half of the 1990’s, when the curve was consistently flatter than current levels and the US economy did just fine, thank you very much."

Game, set and match then? My focus on U.S. yield curve flattening as a "story" could well be overdone. I won't roll over just yet, though. I am not saying that the US curve is about to invert, but I am saying that we're starring down the barrel of a big shift in narrative. If the curve is not on its way to an inversion US 5-year and 10-year bonds are a big sell because the curve is about to shift higher. Alternatively, the Fed's hiking cycle is about to come to a screeching halt. If you don't believe in neither, I don't see how you can dismiss the "risk" of a yield curve inversion in the next few quarters. Perhaps that wouldn't signal what it used to, but I don't think it would be without significance either.

I am also not convinced that the increase in front-end yields is without importance. After all, funding costs of short-term USD financing are up sharply in the past 12-to-18 months. Just because we haven't seen any impact from it does not mean that it won't show up, eventually. After all, corporate America has levered up quite a bit in this cycle.

Finally, this discussion also lends evidence to my story that excess liquidity from central banks fighting unobtainable inflation targets is a powerful narrative. The liquidity engines of ECB and BOJ policy are potent as ever, and investors can ill afford to ignore that.

So what happens next? My guess is that the inversion scare continues a bit longer over the summer. My first chart below shows that trailing returns of U.S. 10-year bond futures have increased substantially, but they could go higher based on their historical performance. The second chart, however, shows that yields in the U.S. could soon get some help from better macroeconomic data. This suggests that the 5-year and 10-year yields eventually will step back from the brink, and push higher. This also chimes with the fact that speculators have recently made a big switch into a net long position on bonds. They could get caught napping if the story changes.

A return of the reflation trade at the end of 2017?

In my excitement over the machinations of U.S. bond markets, I don't want readers to believe that I have forgot about equities. This is, after all, the main asset class through which I express my views on the economy and markets. Amazon stole the spotlight again last week with the acquisition of Whole Woods. The force is strong with this one at the moment. Any stock with a remote exposure to grocery retail got hit as the market immediately discounted the inevitability of Amazon taking over the world in food shopping. The market's fascination with Amazon—and the rest of the usual suspects in the tech space—belies the significant and lucrative churn, which still takes place between sectors. The chart below tries to capture this. It compares trailing returns of the MSCI World GICS1 sectors in the six months ending November, with returns in the six months ending May.

The death of the Trump reflation trade is clear for anyone to see. Financials and energy performed strongly into the end of 2016, but have lost their mojo in the last six months. Tech stocks have increased their momentum, and are now the clear leader. But we shouldn't miss the big jump in performance of consumer stocks, healthcare and utilities. I have been touting healthcare since the beginning of the year, and amid the many single name disasters in the portfolio, I count that as a resounding win. Finally, telecoms continue to lag which makes me comfortable holding a position in Vodafone; it is the fourth biggest holding of iShares' global telecoms ETF. If the flows come back to this sector, Vodafone should benefit.

It stands to reason, however, that if the bond market rally peters out, being overweight defensive sectors is not the right place to be. Indeed, we are perhaps seeing the contours of a return of the reflation trade in light of this year's sluggish performances of financials and energy. I don't think we're there yet. But if recent experience is anything to go by, the churn between sectors is just as important as is the movement in the main indices.

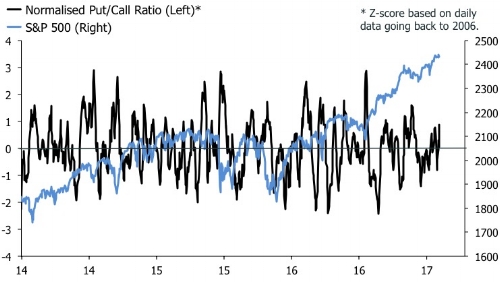

Speaking of which, most of my models continue to signal all manners of severe downside risks for stock markets. I doubt anyone would be surprised if equities took a stumble. But this sentence could easily have been written three months ago—some have been telling similar stories for much longer—and it is not useful to make decisions based on tales of impending doom in equities. I note that the put-to-call ratio on the S&P 500 continues to edge higher, even as the market has been trading sideways. That is not traditionally a sign of complacency. In addition, the large cap U.S. equity index is now trailing its global peers. As a result, a model that prices the S&P 500 off the returns of other major indices currently predicts 4% upside for Spoos. I wouldn't buy the U.S. on this background, but it does suggest that bears looking for a reason to sell global equities should be looking for cracks in large-cap indices outside the U.S.

The thing about major shifts in financial markets is that they tend to happen when investors are looking in the other direction. They also tend to be driven by catalysts that are not the topic du jour on blogs and Twitter. Based on that rule, a yield curve inversion in the U.S. is out of the question. But investors shouldn't cheer prematurely. Experience suggests that the summer lull can be a treacherous one for financial markets.