No Green Shoots in Germany's Trade Data (Either)

As Brad Setser points out today, it is difficult to find the alleged green shoots and second derivatives in today's release of Korea's trade data. True, exports in Korea did pick up in April but are now down in May on a monthly basis and on an annual basis they are down a staggering 28%. This picture is repeated in Taiwan (exports down 31% yoy) albeit with the significant difference that exports are up a bit from April thus corroborating the second derivative discourse. According to Setser, Korea is important since Korea's exports have been less affected by the global downturn than that of Japan and, as we shall see, Germany. Moreover, and much contrary to Germany and Japan Korea's trade surplus have actually improved due to the large drop in commodity prices which is really making itself felt in the annual figures since we are closing in on the months where oil peaked in 2008. Finally, and as many others Brad is looking forward to the release of Chinese trade figures which move us forward towards the answer of a couple of important questions. Brad homes in on the first ...

Like everyone else, I am curious to see what China’s May trade data tells us. If China truly is going to lead the global recovery, China needs to import more – and not just import more commodities for its (growing) strategic stockpiles.

I completely agree here. Another interesting question which the data may help shed light on for us may be the extent of the "recovery" itself and thus the evolution in Chinese exports and particularly imports as a proxy for global trade volume.

Meanwhile and if this was Asia's contribution, via trade data, to the ongoing discussion of whether the bottom has been reached and indeed whether the bloodbath in the US treasury market should make us worry about inflation, Germany's trade data did its part to calm down the bulls even if of course we are trailing the speedy Korean data release by one month here. According to the German stats office the total German export volume, in April, was 63.8 billion Euros to match an import volume of 54.4 billion Euros for a positive balance of 9.4 million. To match these numbers a couple of interesting points stand out.

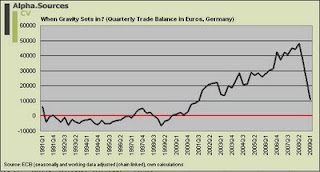

If we look at the annual figures exports were down significantly more (28.7%) than imports (22.9%) which means a narrowing surplus and thus, especially in the case of export dependent Germany, a significant dent in the hopes of recovery. More importantly however from the point of view of the general recovery discourse both exports and imports were down from a the previous month (March) by 4.8% and 5.9% respectively. Together with the message from the Korean trade release, this suggests, as Edward notes, how we have not hit the bottom yet in terms of global trade if of course you see the German data as some kind of proxy here. Indeed, if we look at the figures since Q3/Q4 2008 it is difficult to spot much a second derivative at all. (click pictures for better viewing).

If we look at the evolution of German exports, imports, as well as the balance on quarterly basis the trend is inexorably down. Especially, the plot of the first difference of the trade balance (one year moving average) shows the brick wall Germany has hit with this crisis. Actually, and to put things in perspectives; since Q2-2008 the volume of exports have dropped 4.7% on average each quarter (qoq) compared to a corresponding in imports of 1.9%. In terms of monthly figures the data shows how exports, on average, have dropped by 18.2% each month (yoy) since November 2008. The corresponding number for imports is 11.9%. These two numbers need to be taken with a pinch of salt though since they are neither working day nor seasonally adjusted. The data which tracks changed month-on-month however is. In the same period exports have dropped an average of 4.7% each month compared to with a corresponding number of 3.8% for imports.

All this number salad is then merely to suggest how, when it comes Germany, it seems that we have not yet reached the bottom. This point is hammered down with the recent piece of news from the corporate sector which shows how industrial output declined 1.9 % from the previous month (March).

Germany’s economy may be slow to recover from a record contraction in the first quarter as companies trim jobs and the global slump curbs foreign sales. German exports fell more than economists expected in April and European Central Bank Governing Council member Erkki Liikanen said today that there is “no quick recovery is in sight” for the world economy.

“Today’s numbers are a clear warning against any overhasty optimism,” said Carsten Brzeski, an economist at ING Groep NV in Brussels. “At best, the German economy seems to have entered a period of sideways motion.” Output of investment goods such as machines slumped 6.4 percent in April from the previous month, today’s report showed. Production of intermediate goods fell 1 percent and manufacturing output slipped 2.9 percent from March.

Coupled with the first piece of trade data from Q2 suggesting a continuing slide one has to wonder where people are getting all this recovery hype about. Oh wait a minute, I know; it's the US treasury yields stupid!

Well, be it as it may, I am in less of a disagreement than it seems with the bulls. As I have articulated at length recently, there are green shoots to be found and this may have real economic implications. You just need to know where to look.