Back to Basics

Update: A kind reader has alerted me to a big mistake. In the first version of this post I said that the RBA recently hiked rates. They didn't although they are, according to the market, thinking about it. I apologise for that blooper. Let's just call it wishful thinking or something.

--

Last week I tumbled down the rabbit hole of quantitative finance, so this week I thought that I would take stock on some of the main themes. In addition, I am going on holiday soon, which means that you will have to survive without my mishaps for a couple of weeks. The continued woes of the greenback are probably the main story for markets at the moment. It is driven by a number of factors as far as I can see. Firstly, economic data in the U.S—in particular core inflation—have remained underwhelming, which have forced markets to roll back on their expectations for Fed rate hikes. September, which was a done deal only a few months ago, has now become a long shot. Secondly, just as the Fed's hiking cycle potentially has hit a snag, other central banks have stirred.

The Bank of Canada recently hiked rates—and the Reserve Bank of Australia are allegedly thinking about it—and in the Eurozone, Mr. Draghi's attempts to talk EURUSD back into range last week failed. Markets have even speculated about a pre-emptive hike by the Bank of England to prevent a further slide in sterling, although the recent CPI data likely have put that particular genie back in the bottle. Bloomberg's First Word strategists are not convinced;

Yes, the "QE and low-rate party" has to come to an end at some point. And market participants are understandably worried about how they will be weaned off the current highly-liquid environment. With global inflation still looking anaemic, monetary tightening, if there’s any in the near-term, is likely to be at a very gradual pace

(...)

The Reserve Bank of New Zealand is unlikely to want to repeat the episode of 2014, when it raised rates only to end up cutting them again. Given second-quarter inflation came in below estimates this week, hawkish commentary doesn’t appear a viable option at its August meeting, particularly as it would in all likelihood send the kiwi higher

(...)

It’s even questionable how hawkish the Bank of Canada was last week. Yes, they raised rates and signaled that another one may be coming, but as always it appears it’s data dependent. Any disappointment there may see Stephen Poloz and his cohort singing a different tuneIf this keeps up, investors may very soon be watching the birth of a new breed of central bank bird: the "dovish hawk."

That's all well and good, but the end result of all this is that the headline DXY index is off almost 9% since the middle of December 2016. This is highly amusing given that the continuation of the dollar bull market was the strongest consensus trade at the start of the year. If we zoom out for a minute, though, the big picture hasn't necessarily changed that much. The chart below shows that the DXY is still within the range established following the initial rise, in 2014, out of its post-crisis range. A break below 93 would force many to rethink their world views I imagine. We're getting closer, but we're not there yet.

An interesting corollary to the recent rearrangement in global FX markets is that the BOJ, unlike other global central banks, is still not ready to declare that it is confident in reaching its objectives, whatever they are. As a result, we have to assume that the BOJ is ready to defend its 0% yield target on the 10-year even as its peers are slowly trying to get off the ground. In currency land, this effectively translates into a return of the yen carry trade, and perhaps even Ms Watanabe and her margin account. This time around, however, we probably have to come with a nickname for the corporate treasurer, who is the one wielding the savings now. The idea that Japan is always the last one to move takes us back to 2007 when the world's central banks also were raising rates, but the BOJ were struggling. At that time, meetings among G7 finance ministers were used in part to warn about financial instability from growing yen carry trade flows, with the implicit suggestion that the BOJ should get a move on. It did, eventually, just ahead of the crash. Before that, however, "high yielding" currencies such as AUD, CAD, and many EM had big moves. EURJPY and USDJPY will be interesting this time around too if Kuroda-san sticks to his 0% target. Bloomberg's Cameron Crise sums it up nicely, with a warning.

Although the growth of BOJ JGB holdings has slowed in recent months, suggesting a de facto tapering, the bank’s stated commitment to its easing program remains unwavering. Its recent bid for an "unlimited amount" of 10-year JGBs was a potent symbol of determination. Small wonder the market has embraced yen shorts!

(...)

But euro longs and yen shorts would do well to remember that when positioning is stretched, it might not take much to send the market going the wrong way.

What else is new?

The flip side of a weaker dollar and disappointing macroeconomic data in the U.S. is that the U.S. yield curve remains flat, even factoring the modest increase in 10-year and five-year yields in the past month. The next chart suggests, however, that it wouldn't take a much of an improvement in the data to steepen the curve.

My gut feeling says that we need one more deep dive in U.S. long-term yields—which could well take a September hike off the table—to clear the air. If that happens, though, a reprise of the reflation trade in equities via financials and energy will be the place to be. Speaking of equities, the global benchmarks sold off marginally in the beginning of July, but have since rebounded, mainly due to higher prices of U.S. and EM equities; the Eurozone has lagged since May despite the increasingly bullish consensus outlook for the region and its equities. I am all for a bullish Eurozone growth story, but a lot has already been priced in by equities. The next chart shows one indication of this via the divergence between the surging inflow into Vanguard's European equity fund, compared with more modest flows into its U.S. and global funds. Other indicators could reasonably tell a different story, but I think it fits with the overall picture we're seeing in markets.

In terms of equity valuations, I sympathise with those trying to maintain their sanity. The chart below shows that the global benchmark indices are either eye-wateringly expensive or close to being so.

Trading the benchmark index based on headline valuations, however, has been a disastrous strategy in this cycle, so far at least. The recent softness in markets has played out like most periods before it. The market has lost momentum, but instead of fulfilling the bears' dreams of a crash, it appears to be working off its excess by moving sideways, setting up for a push higher. The S&P 500 has been the poster child for this in this cycle. It will end eventually, but I am not sure now is the time. The chart below shows that good'ol Spoos actually is undervalued based on a standard arbitrage pricing model. It is no guarantee of upside, but it suggests that large cap U.S. equities isn't the worst place for a global macro manager to be relative to other major asset classes, at least in the near term.

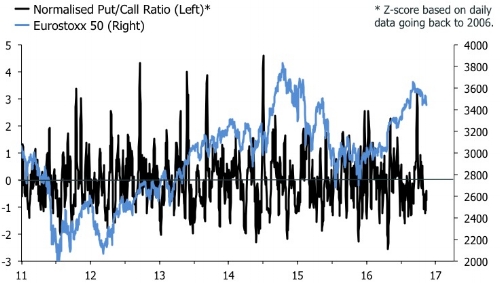

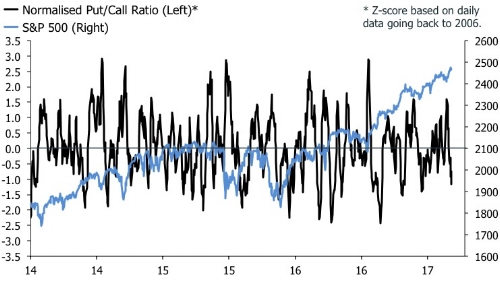

For the sake of balance, I leave you with evidence that does point to short-term downside risks for global equities, in this case the S&P 500 and the Eurostoxx in Europe. The two charts below show that put-to-call ratios have declined sharply on both indices, which suggest that complacency is creeping in as traders prepare for their summer holidays. The price action in Europe is particularly interesting given that the Eurostoxx has edged lower since May. Normally, investors are buying protection as the market slips following a strong run, but not on this occasion; such is the belief in the bullish Eurozone story at the moment it seems.

Looking beyond the headline indices, the Q2 earnings reports have so far been a mixed blessing for the portfolio. Decent numbers from Syntel drove a big, and much welcome, short squeeze, and I hope that it is the beginning of a more sustained move. Elsewhere, markets didn't like the news from General Electric, signalling that I might have donned the kevlar glove too early on that one. More generally, I think telecoms is currently the most attractive global GICS 1 sector; I am positioned accordingly via AT&T—replacing a winning position in Vodafone—and I am sniffing around for a decent ETF which isn't too expensive. In the main, I am trying to favour assets that are cheap relative to their own long-run trends and the market, and which have recently underperformed. In other words, I am trying to stick to the basics.