Is it time to get defensive?

We have barely recovered from the hangover acquired on New Year's Eve, and I am already tired of the memes and narratives being used to label 2017. I like to believe that I have a decent bullshit-filter, but I have realised that it needs a serious upgrade in the wake of recent geopolitical festivities. Call it the January blues, but the idea of re-engaging with the Trump/Brexit crap-shooters doesn’t exactly fill me with joy. The upshot, I suppose, is that it forces me to keep the eye on the ball. In that vein, the tradition of financial market analysis at the dawn of a new year suggests that I present a list of list of 2017 (non)predictions and themes. But I won’t. This already has been done ad nauseum by other prominent members of the peanut gallery. Instead, I want to pick up where I left before I dialled down for the Christmas break.

The outperformance of cyclical relative to defensive equities—and the associated rise in bond yields—was a key theme in Q4-16, and many strategists and economists argue that it will carry over to become a key story for 2017. That might well be, but nothing in financial markets moves in a straight line, and I think this particular meme is looking tired. Exhibit one is that trailing year-over-year returns of cyclicals relative to defensives—using GICS 1 sectors on the MSCI World—jumped to 14% in December. That is not as high as surge in the rebound following the crash in 2008, but it is not far from other peaks.

Cyclicals have come roaring back; can it be sustained.

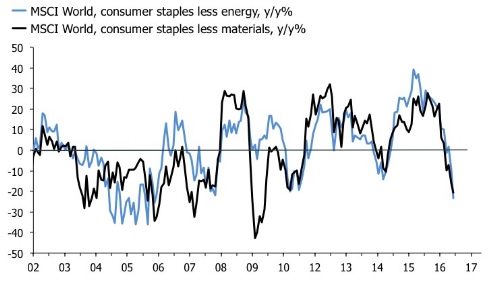

One of the main underlying sector stories in the past 12 months has been the mean-reversion trade in energy and commodity stocks relative to consumer stocks. This is a classic story of markets moving ahead of economic data. Inflation is only now starting to come through in the main global CPI and PPI indices, but the next chart shows that equities have discounted the shift already. Investors looking to add exposure to the energy/commodity complex to "take advantage" of accelerating global inflation likely will find that equity markets already have run away with the prize.

The energy complex already have discounted the rise in global inflation

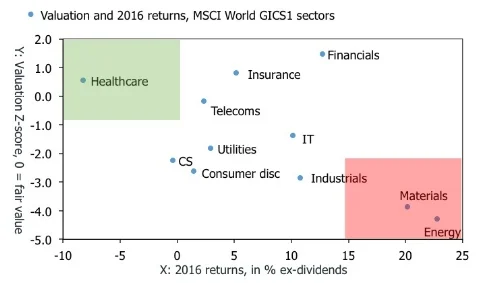

This is only one of the themes, though. The next chart tries to show to capture the full account the GICS 1 sector break-down heading into Q1. The upper left green quadrant represents the combination of poor trailing returns, and attractive valuations. Conversely, the red quadrant to the bottom right shows the sectors that are expensive with high trailing returns.

Focus on healthcare for picks on the long side

The chart essentially tells four stories. Firstly, it chimes with the point made above that the outperformance of the industrial/energy complex is ripe for a fade. Secondly, it points to healthcare as the most attractive sector for investors to go hunting for “bargains.” Thirdly, it implies that financials remain attractive based on valuations, despite solid performance in 2016. Finally, it suggests that valuations for consumer staples and discretionaries are not attractive, despite poor performance in 2016.

This type of "Dogs of the Dow” analysis comes with the traditional health warnings. It doesn’t always work, and generally does not backtest well. But if the alternative is shooting arrows into the dark void, I will take my chances with this little framework.

Another primary indicator increasingly showing support for a defensive v cyclical stance is the stock-to-bond ratio. It’s not yet extreme in the U.S., but it has climbed significantly, and supports my inclination towards the idea that the great Trump reflation trade isn’t going to last a whole lot longer. In Germany it also has made a spectacular rebound following the nadir of a trailing 25% in February last year. An investor only armed with this chart would be buying bunds and selling the DAX here.

Will U.S. stocks continue to outpace bonds?

Buy bunds, sell DAX 30?

Leaving the comfortable world of relative performance, the idea of looking for opportunities on the long side is challenged by the overall story of a late economic cycle, at least in the U.S. At face value, the Trump policy mix entails significantly tighter domestic financial conditions via higher rates and a stronger dollar. And if the U.S. economy falters, history suggests that equity exposure will be painful for portfolios. I concede that the future of the Trump-story is clouded in huge uncertainty. But it is being presented to equity investors at time when multiples already are demanding across most benchmark indices. Most of my strategic models continue to suggest that steering clear of beta is a good idea. David Rosenberg showed the following chart to his readers recently, and the second chart below is a collection of static valuation scores of the world’s leading indices. Even for adept stock pickers, the outlook looks challenging.

Everything is possible, but the air is getting thin

Where is the value?

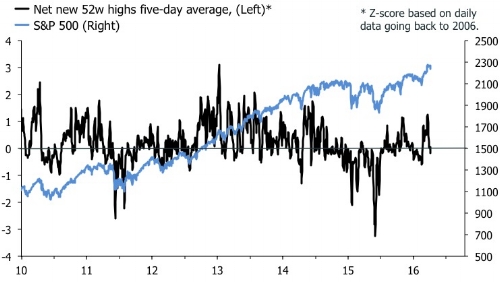

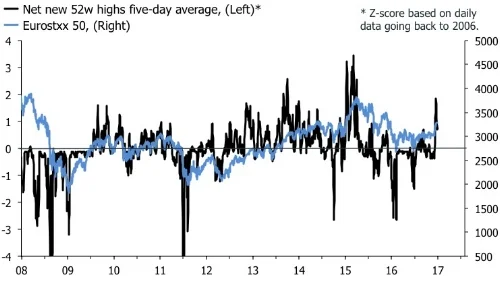

Tactically, the very recent price action in Spoos also suggests leaner times for the longs. But it is difficult to say whether this is just a little bit of profit-taking following a juicy Santa rally, or whether it portends the beginning of a more serious sell-off. My models suggest the latter, but they were blown out of the water in Q4, so my conviction isn’t exactly high. Doing a little cherry picking among my indicators, though, I note that breadth measured by net new 52w lows has dipped below zero again. This isn’t normally a good sign, and usually suggests that the bears will be doing driving, at least for a while. Of course, this index remains positive in the Eurozone—mainly due to the ongoing rally in financials— so even here the story isn’t straight-forward.

Will the bears pounce on deteriorating breadth in Spoos?

Can EZ banks keep it up?

The rather disappointing conclusion from the exercise above is that the advent of 2017 hasn't been a catalyst for a huge new range of opportunities, despite strategists' attempts to paint exactly that picture. As far as equities go, my reading remains that the market was priced for weakness in Q4, but that the Trumponomics narrative proved a powerful cocktail to vanquish the threat of extended valuations. I am open to the idea that the market is correct in betting on Trump, although I am sceptical. But no matter how powerful a story is, investors should always consider its price. And right now, the price of the reflation trade looks too steep. Playing offence was a great strategy in Q4, but for now I prefer to play defence.