Global Leading Indicators, June 2025 - What Tariffs?

The June 2025 edition of the global LEI chartbook can be found here. Additional details on the methodology are available here.

Global leading indicators improved further at the end of Q2, as markets and decision-makers in the real economy concluded that Mr. Trump’s tariff threats are more bark than bite. However, the U.S. President has since rekindled his appetite for tariffs, unveiling several high-profile measures targeting Asian economies, along with the weekend bombshell of a 30% tariff on imports from Mexico and Europe.

Granted, these—and other recently announced tariffs—aren’t scheduled to take effect until early August, leaving ample time for Mr. Trump to backtrack. That’s precisely what markets, and most observers, expect. Still, the question now is whether markets will need to ramp up the pressure to compel a reversal, potentially triggering a sell-off in risk assets over the coming weeks. I suspect the answer is yes, particularly after the latest escalation involving the EU. More broadly, the concept of “Schrödinger’s Tariffs”—tariffs that raise revenue, have no effect on prices or inflation, and don’t harm US corporate margins—may exist in the minds of Mr. Trump and his closest economic advisors, but they don't exist in reality. The economic trade-offs and costs will eventually need to be negotiated in Washington.

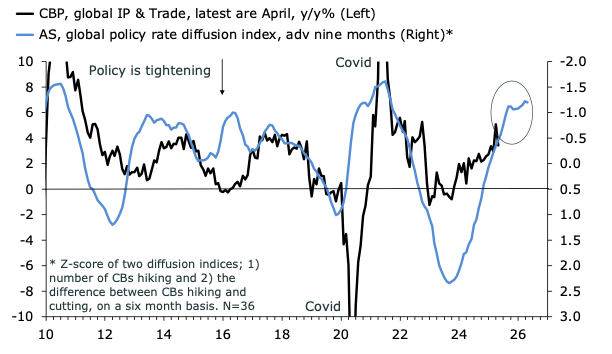

Beyond tariffs, signs of a softening U.S. labor market, and to a lesser extent renewed weakness in oil prices after temporary leap during the US/Israel-Iran skirmish, have increased the likelihood of further monetary policy easing in developed markets. This creates a precarious equilibrium for markets banking on a Goldilocks scenario. U.S. rate cuts, for example, can support asset prices and economic momentum only if they respond to a slowdown, not a recession. Remarkably, global monetary policy—measured by the number of central banks cutting versus hiking—has eased significantly over the past 12 months, as the chart below shows. This has occurred even as the Fed has remained constrained by a resilient domestic economy and inflationary pressures from tariffs. Typically, the Fed leads global policy shifts; this time, it could be a welcome latecomer to the easing cycle, potentially providing a boost to risk assets and global cyclical conditions more broadly.

And the Fed hasn’t really joined the party, yet

As of June, 12 out of 16 leading indicators in the sample were trending upward—up from 10 in both May and April—signaling a robust upturn in global economic activity despite volatility in confidence metrics and the lingering effects of the trade war. This suggests a relatively volatile path over the past year, but also a broadly resilient trend. Based on June data, the global economy has experienced a broad-based cyclical upturn since mid-2024, with little sign of weakness heading into Q3.

Coincident indicators dipped in April after a March surge driven by tariff front-running. Nevertheless, the underlying trend remained solid and upward at the start of Q2, aligning with the message from leading indicators.

The rolling three-year Z-score of the global LEI—a typical leading signal for the headline index—edged higher in June, with May’s decline revised upward. This leaves a more robust picture than May initially suggested, though a closer look clearly indicates that momentum is now stalling. This, in turn, implies that the upturn in global leading indicators is running out of steam, hinting at more pronounced weakness by the end of the year.

Equity markets have rebounded, mirroring easing concerns over U.S. economic policy following the April panic and reflecting the broader resilience in leading indicators. Given signs of stabilization, equities may have further to run, though a volatile month likely lies ahead as markets again attempt to coax Mr. Trump down from the tariff tree.

As of June, the first principal component (PC1) of the global LEIs remained in a downward trend. PC1 captures the common cyclical signal across countries and typically peaks during synchronized global downturns—illustrating the “everything is correlated in a crisis” phenomenon. Its ongoing weakness suggests divergence across national indicators and, for now, hints at underlying resilience.

Country-level data have also improved markedly in the June release. The previously expected downturn in the U.S. LEI has been revised away, with only a handful of countries—Spain, Turkey, Indonesia, and Japan—showing negative momentum. Brazil remains borderline. Elsewhere, leading indicators are “high and rising” on a six-month basis. Germany stands out on the upside, signaling that firms and markets are looking past near-term tariff uncertainty and anticipating a more favorable domestic growth and policy environment.